IRS Releases 2024 Tax Brackets, Retirement Contribution Limits

The Internal Revenue Service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2024 tax year. While these taxes are not due for some time, it may benefit you to start thinking ahead.

Overall, more than 60 provisions have changed. Here are a few of the most critical tax bracket and retirement contribution limit changes.

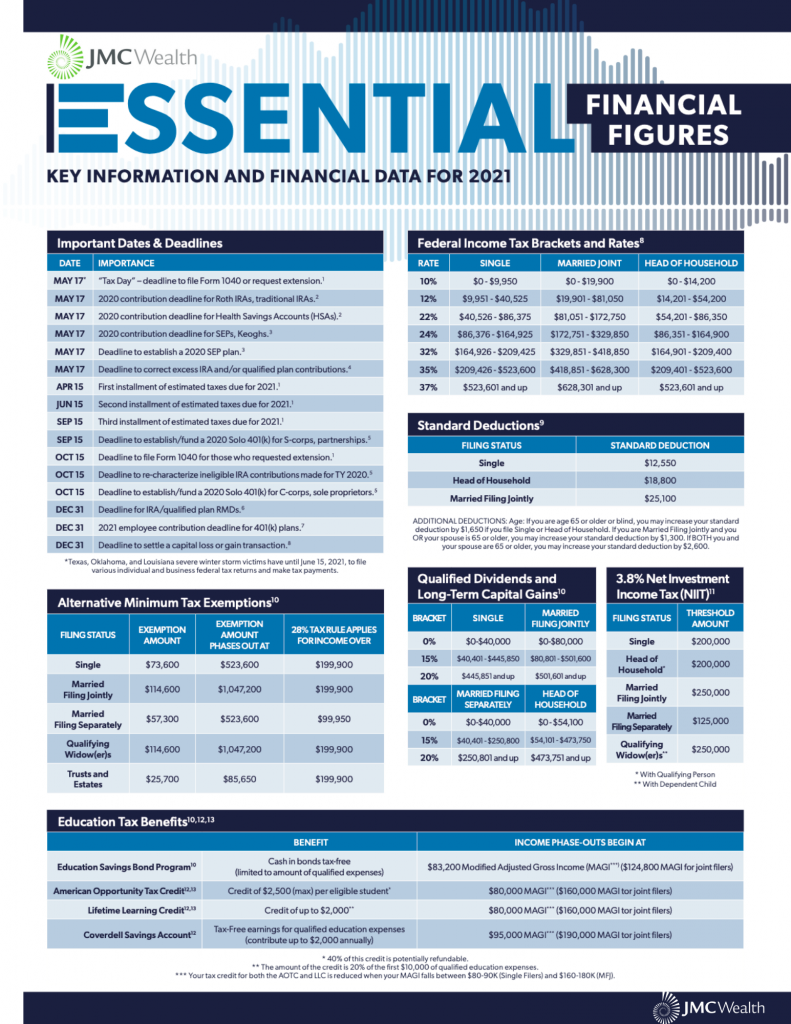

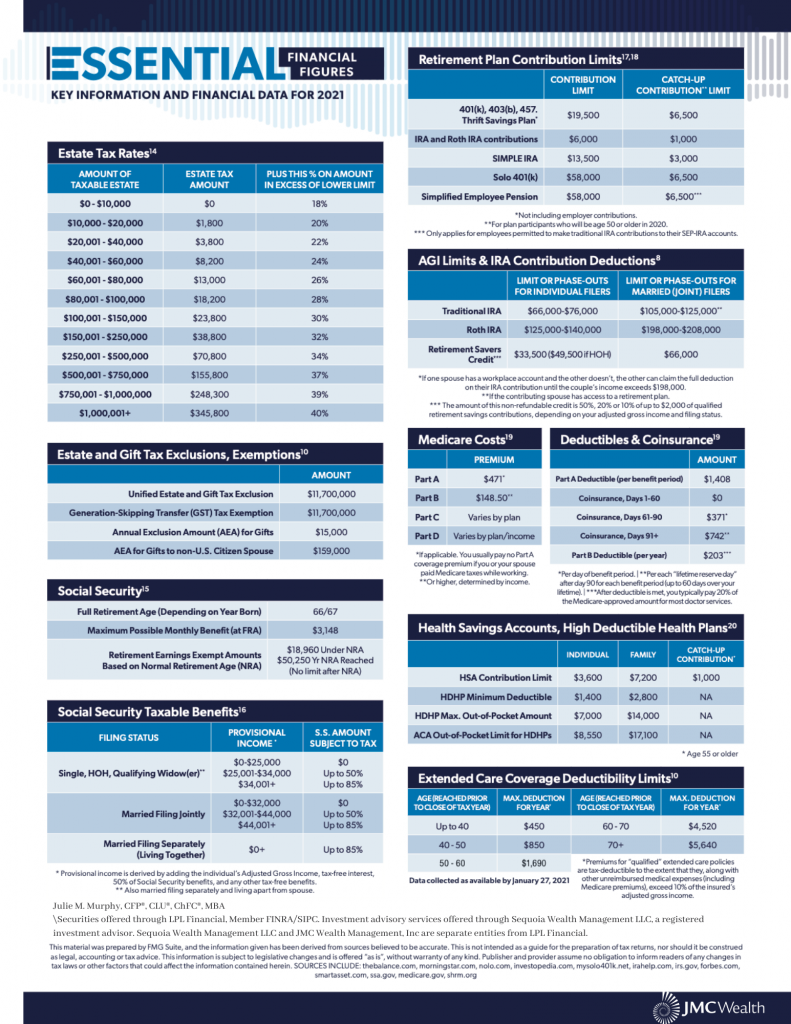

Tax Bracket Inflation Adjustment

Overall, tax brackets have been adjusted upwards by 5.4% for 2024. The primary purpose of this adjustment is to account for inflation, which is based on the Consumer Price Index. The government’s goal is to keep income taxes in sync with consumer buying power.

Standard Deduction

The standard deduction has increased to $29,200 for married couples filing jointly, up $1,500 from the previous year. For single filers, this number increased by $750 to $14,600.

Individual Retirement Accounts (IRAs)

IRA contribution limits are up $500 in 2024 to $7,000. Catch-up contributions for those over age 50 remained at $1,000, bringing the total limit to $8,000.

Roth IRAs

The income phase-out range for Roth IRA contributions increased by $8,000 to $146,000-$161,000 for single filers and heads of household. For married couples filing jointly, phase-out will be $230,000 to $240,000 (a $12,000 increase). Married individuals filing separately see their phase-out range remain at $0-10,000.

Workplace Retirement Accounts

Those with 401(k), 403(b), 457 plans, and similar accounts will see a $500 increase for 2024, bringing the total maximum contribution amounts to $23,000. The catch-up contribution for those aged 50 and older remains at $7,500, bringing their total limit to $30,500.

Gift Tax

The annual gift tax exclusion is now $18,000 for 2024, an increase of $1,000 from the previous year.

Remember that we provide updates for informational purposes only, so consult with your tax professional before making any changes in anticipation of the new 2024 levels. You can also contact our offices, and we can provide information about the pending changes.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite.

Social Benefits

One of the risks associated with retirement is increased isolation, which in terms of its impact on your health, has been equated with smoking fifteen cigarettes a day. Working with others reduces this risk, giving you a chance to build connections and enjoy meaningful interactions.5

5. UNH.edu, May 8, 2023

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2023 FMG Suite.